Key takeaways from the webinar on opportunities for Ukrainian business development with Sweden

Key takeaways from the webinar on opportunities for Ukrainian business development with Sweden

BDO in Ukraine, in cooperation with the Swedish-Ukrainian Chamber of Commerce, held the second event “Sweden: Opening Opportunities for the Development of Ukrainian Business” in the series of events dedicated to the development of international activities of Ukrainian entrepreneurs.

The attendees were many representatives of Ukrainian companies from various industries exploring new business opportunities in Scandinavia (notably, Sweden). The event featured both Ukrainian and foreign speakers who provided practical insights and examples of successful expansion into the Swedish market. Speakers emphasized the importance of understanding the economic climate, identifying infrastructure challenges and considering capacity for investment and cooperation with the Scandinavian market.

Vira Savchenko, CEO of BDO in Ukraine moderated the event. For almost 2 years now, Ms. Savchenko has been actively involved in attracting financing to Ukraine for the private sector, as well as finding new opportunities for Ukrainian companies in foreign markets. Based on our inquiries, Sweden is referred to as a direction for the Ukrainian business to cooperate with.

When identifying the market potential, it is crucial to scrutinize consumer demand in the market and local preferences. This issue was addressed by Lyudmila Lemrini, President of the Swedish-Ukrainian Chamber of Commerce in Scandinavia, who detailed the Swedish consumer market and noted that the Swedish market is one of the most developed in Europe with high purchasing power of population. The main trends in Swedish consumer demand are high environmental awareness, quality and health priorities, as well as a considerable interest in digital solutions and innovative products. However,, the market is limited, as the population of Sweden is about 10 million people and the Swedes primarily support domestic producers. Nevertheless, many Ukrainian producers already supply products and services to the Swedish market, which confirms their high quality and provides access to other markets with high quality standards.

Tove Antonissen, Export Strategy Expert at Straight Circles, who has been advising companies on building export strategies and helping them enter these markets for many years continued on exporting to the Swedish and EU markets. The speaker explained the basic principles of the EU and Swedish internal markets, having provided useful resources for researching markets and export requirements. Tools such as Open Trade Gate Sweden, summarizing the Swedish market, and EU Access2Markets, being a useful tool for analyzing market opportunities across the EU, were presented. Special attention was paid to the RAPEX and RASFF tools. RAPEX (Rapid Alert System for Non-Food Products) ensures the rapid detection and removal of unsafe products from the market, and RASFF (Rapid Alert System for Food and Feed) is aimed at protecting food and feed. This helps ensure the high quality and safety of products exported to the EU.

Tove Antonissen also mentioned the impact of the European Green Deal on businesses. This initiative aims to create a circular economy, reduce waste and achieve climate neutrality. Much attention is now paid to such issues.

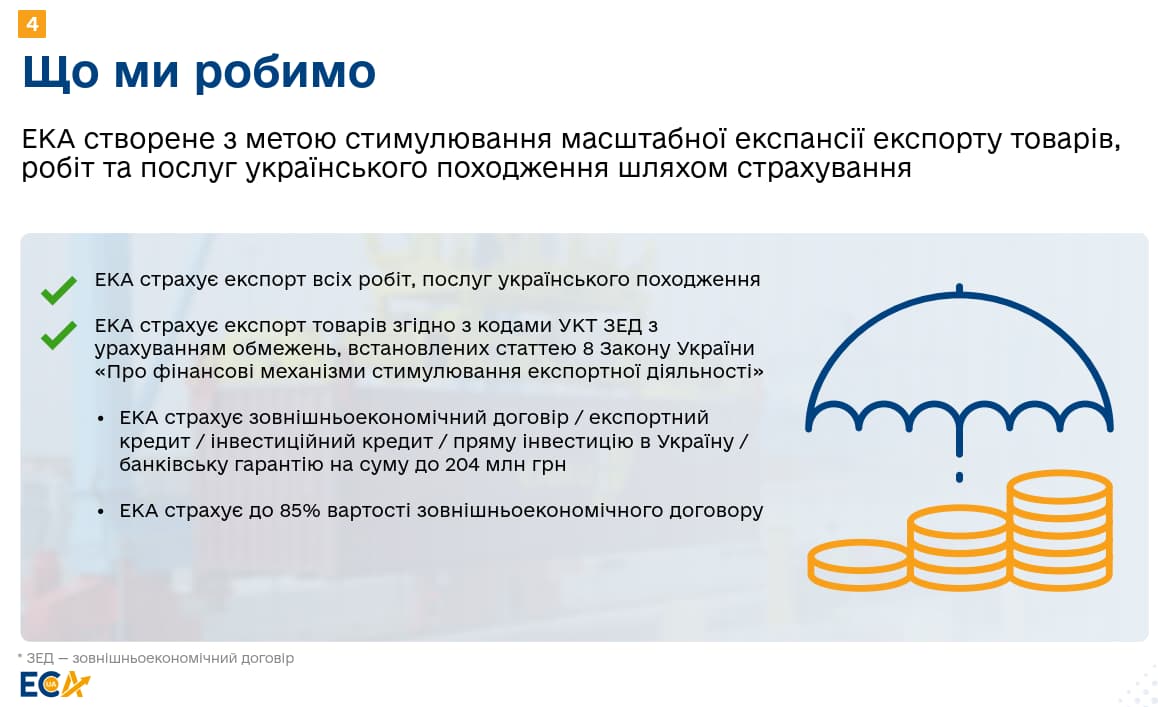

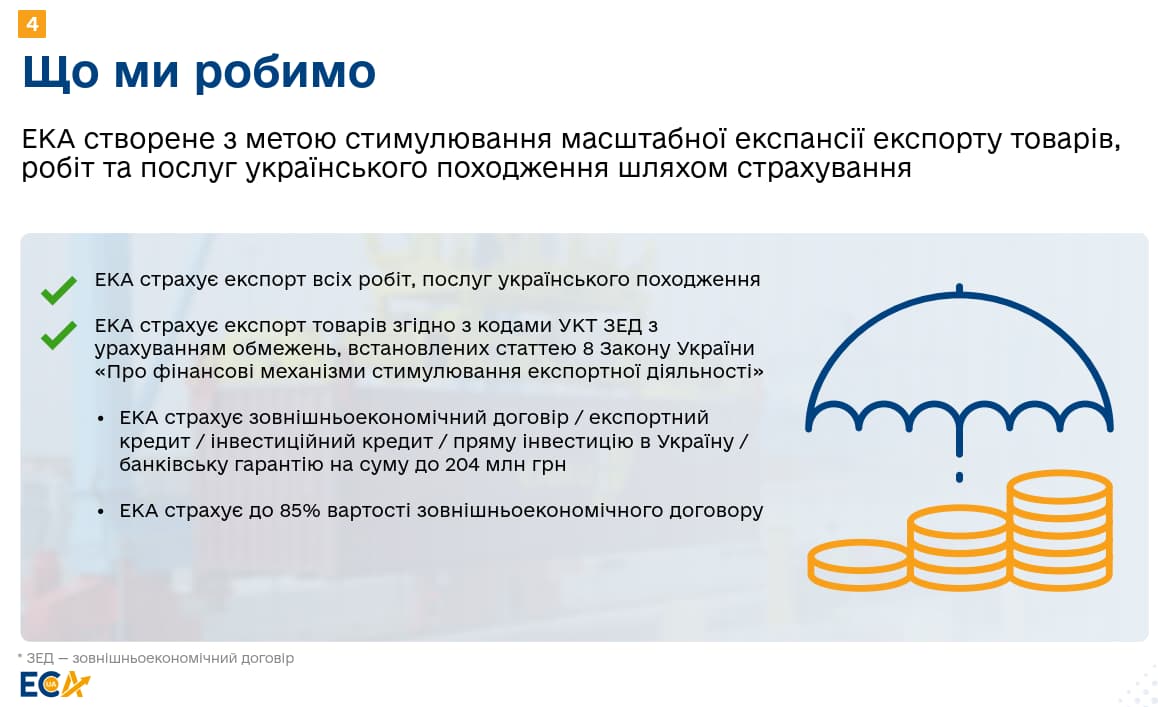

Export opportunities for Ukrainian business were covered by Denys Garasiuta, SME Development Specialist at the Export Credit Agency of Ukraine (ECA), which helps Ukrainian exporters to be competitive in the global market by providing insurance for export contracts, loans and investments, and minimizes risks associated with export activities. Over the two years of the agency's operation, the volume of supported exports amounted to over UAH 12.8 billion.

Mr. Garasiuta highlighted the main challenges currently faced by our exporters. Among the main ones are logistical difficulties, limited financial instruments, insufficient promotion of Ukrainian business interests, high costs of preparing for export, and others. But challenges bring up opportunities. Therefore, the agency's goal is to provide financing opportunities for Ukrainian companies, including export credits and export insurance. The speaker noted: “For the countries of the first group, insurance rates are up to 1%. The maximum amounts that can be insured under an export contract or financing are limited to 10% of the agency's current capital, which is approximately UAH 180 million.” Denys Garasiuta emphasized the importance of cooperation with partner banks that provide loans secured by ECA insurance contracts, which simplifies access to financing for exporters. Today, ECA's partner banks are PrivatBank, Oschadbank, FUIB, UkrEximBank, UkrgasBank, KredoBank, Pivdenny Bank, Raiffeisen Bank, MTB Bank, and Creditwest Bank.

Another part of the event was devoted to the issues of Ukrainian importers looking for cooperation with foreign suppliers. Johan Dahl, a representative of the Swedish Export Credit Agency (EKN), spoke about EKN's programs to cover Swedish export transactions with a letter of credit (confirmed or unconfirmed) issued by a Ukrainian bank and programs to cover credit risks of Swedish exports for Ukrainian buyers. The special guarantee fund currently stands at SEK 333 million (EUR 30 million) for 2024-2026, which is likely to be increased and extended.

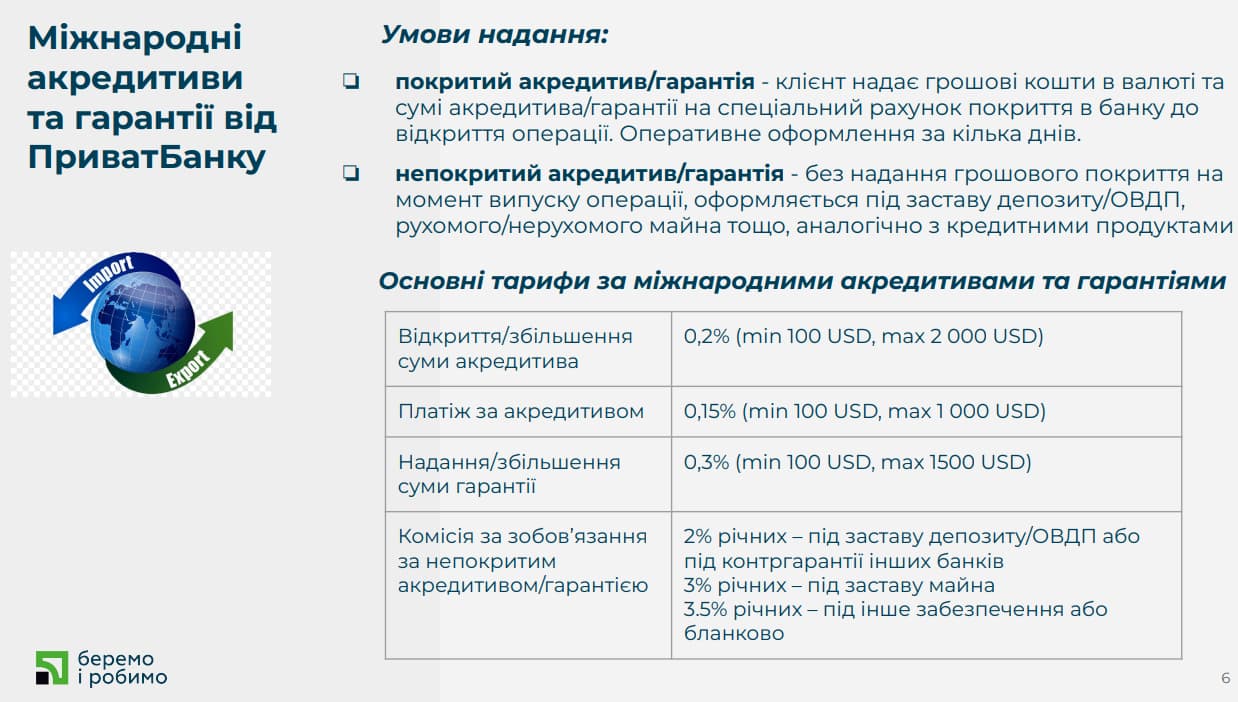

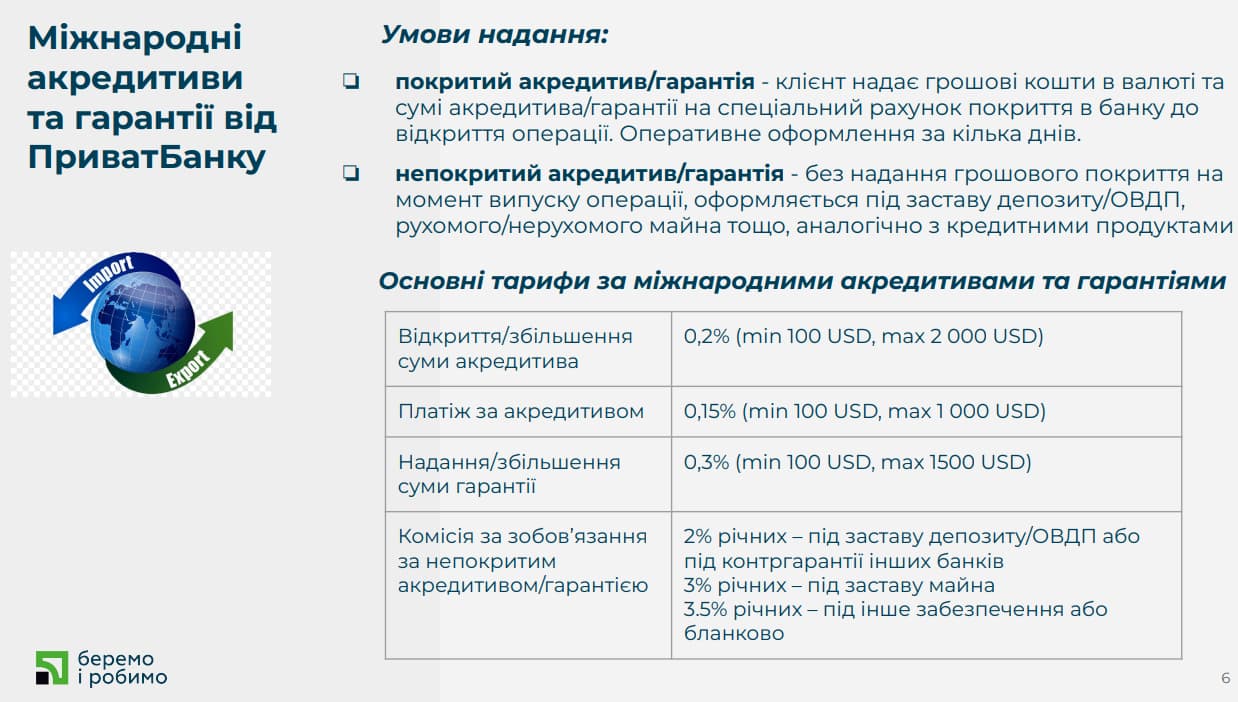

And in conclusion, together with Oleg Kovalenko, Head of Documentary Business and Trade Finance at PrivatBank, we talked about the bank's services for importers of products from Sweden, namely the possibility of using letters of credit and guarantees for Ukrainian importers. According to the speaker, customers importing goods from Sweden can obtain a letter of credit or guarantee from PrivatBank with confirmed and/or deferred payment. The exporter's risks are covered by the Swedish export credit agency EKN (there are no agreements between PrivatBank and EKN). Special export credit guarantees are provided by EKN in favor of a Swedish exporter or a foreign financing bank and make investments in Ukraine easier and less risky. The maximum amount of EKN's insurance coverage is 80% of the transaction amount, and the maximum period of risk coverage (deferred payment) is 1 year. The EKN insurance premium is 2.92% per annum.

Benefits for importers from the use of letters of credit and guarantees:

If you consider entering the Scandinavian market or are already operating in Sweden, BDO in Ukraine and SUCC are ready to offer comprehensive support. From tax advice to integration with the local regulatory framework, we will help you understand all aspects of doing business in or with Sweden. Contact us for more information. Do not miss the chance to take advantage of unique opportunities offered by the Swedish market!

Vira Savchenko, CEO of BDO in Ukraine moderated the event. For almost 2 years now, Ms. Savchenko has been actively involved in attracting financing to Ukraine for the private sector, as well as finding new opportunities for Ukrainian companies in foreign markets. Based on our inquiries, Sweden is referred to as a direction for the Ukrainian business to cooperate with.

When identifying the market potential, it is crucial to scrutinize consumer demand in the market and local preferences. This issue was addressed by Lyudmila Lemrini, President of the Swedish-Ukrainian Chamber of Commerce in Scandinavia, who detailed the Swedish consumer market and noted that the Swedish market is one of the most developed in Europe with high purchasing power of population. The main trends in Swedish consumer demand are high environmental awareness, quality and health priorities, as well as a considerable interest in digital solutions and innovative products. However,, the market is limited, as the population of Sweden is about 10 million people and the Swedes primarily support domestic producers. Nevertheless, many Ukrainian producers already supply products and services to the Swedish market, which confirms their high quality and provides access to other markets with high quality standards.

Tove Antonissen, Export Strategy Expert at Straight Circles, who has been advising companies on building export strategies and helping them enter these markets for many years continued on exporting to the Swedish and EU markets. The speaker explained the basic principles of the EU and Swedish internal markets, having provided useful resources for researching markets and export requirements. Tools such as Open Trade Gate Sweden, summarizing the Swedish market, and EU Access2Markets, being a useful tool for analyzing market opportunities across the EU, were presented. Special attention was paid to the RAPEX and RASFF tools. RAPEX (Rapid Alert System for Non-Food Products) ensures the rapid detection and removal of unsafe products from the market, and RASFF (Rapid Alert System for Food and Feed) is aimed at protecting food and feed. This helps ensure the high quality and safety of products exported to the EU.

Tove Antonissen also mentioned the impact of the European Green Deal on businesses. This initiative aims to create a circular economy, reduce waste and achieve climate neutrality. Much attention is now paid to such issues.

Export opportunities for Ukrainian business were covered by Denys Garasiuta, SME Development Specialist at the Export Credit Agency of Ukraine (ECA), which helps Ukrainian exporters to be competitive in the global market by providing insurance for export contracts, loans and investments, and minimizes risks associated with export activities. Over the two years of the agency's operation, the volume of supported exports amounted to over UAH 12.8 billion.

Mr. Garasiuta highlighted the main challenges currently faced by our exporters. Among the main ones are logistical difficulties, limited financial instruments, insufficient promotion of Ukrainian business interests, high costs of preparing for export, and others. But challenges bring up opportunities. Therefore, the agency's goal is to provide financing opportunities for Ukrainian companies, including export credits and export insurance. The speaker noted: “For the countries of the first group, insurance rates are up to 1%. The maximum amounts that can be insured under an export contract or financing are limited to 10% of the agency's current capital, which is approximately UAH 180 million.” Denys Garasiuta emphasized the importance of cooperation with partner banks that provide loans secured by ECA insurance contracts, which simplifies access to financing for exporters. Today, ECA's partner banks are PrivatBank, Oschadbank, FUIB, UkrEximBank, UkrgasBank, KredoBank, Pivdenny Bank, Raiffeisen Bank, MTB Bank, and Creditwest Bank.

Another part of the event was devoted to the issues of Ukrainian importers looking for cooperation with foreign suppliers. Johan Dahl, a representative of the Swedish Export Credit Agency (EKN), spoke about EKN's programs to cover Swedish export transactions with a letter of credit (confirmed or unconfirmed) issued by a Ukrainian bank and programs to cover credit risks of Swedish exports for Ukrainian buyers. The special guarantee fund currently stands at SEK 333 million (EUR 30 million) for 2024-2026, which is likely to be increased and extended.

And in conclusion, together with Oleg Kovalenko, Head of Documentary Business and Trade Finance at PrivatBank, we talked about the bank's services for importers of products from Sweden, namely the possibility of using letters of credit and guarantees for Ukrainian importers. According to the speaker, customers importing goods from Sweden can obtain a letter of credit or guarantee from PrivatBank with confirmed and/or deferred payment. The exporter's risks are covered by the Swedish export credit agency EKN (there are no agreements between PrivatBank and EKN). Special export credit guarantees are provided by EKN in favor of a Swedish exporter or a foreign financing bank and make investments in Ukraine easier and less risky. The maximum amount of EKN's insurance coverage is 80% of the transaction amount, and the maximum period of risk coverage (deferred payment) is 1 year. The EKN insurance premium is 2.92% per annum.

Benefits for importers from the use of letters of credit and guarantees:

- possibility not to make an advance payment under the contract;

- possibility to receive a deferred payment (commodity credit);

- payment only if the terms of the letter of credit are met.

- guarantee of payment, possibility to obtain financing from a foreign bank

- minimization of numerous economic and political risks in international trade, especially in times of war.

If you consider entering the Scandinavian market or are already operating in Sweden, BDO in Ukraine and SUCC are ready to offer comprehensive support. From tax advice to integration with the local regulatory framework, we will help you understand all aspects of doing business in or with Sweden. Contact us for more information. Do not miss the chance to take advantage of unique opportunities offered by the Swedish market!