BDO in Ukraine keeps promoting the development of Ukrainian business in the international arena, helping companies both develop new markets and gain competitive advantages. On March 19, 2025, together with the Canada-Ukraine Chamber of Commerce, the Embassy of Ukraine in Canada, the NAZOVNI platform and the Toronto-Kyiv Complex, we hosted the webinar “Partnership across the Ocean: Challenges and Opportunities for Ukrainian Companies in Canada”.

The event was moderated by Vira Savchenko, CEO of BDO in Ukraine, taking the lead in the discussion as well as focusing on key issues for Ukrainian exporters, ensuring a productive exchange of experience between participants and speakers.

Despite its relatively small population of 40 million, Canada is one of the world’s leading economies, boasting high purchasing power, making it an attractive market for Ukrainian exporters. Furthermore, Canada is one of the world’s leading importers on a per capita basis. Given that the service sector in Canada accounts for 74% of its GDP, it is recommended that Ukrainian entrepreneurs focus on high-tech and innovative industries, where demand is growing steadily.

Canada’s demographic landscape exerts considerable influence on consumer preferences and the demand for goods. The country’s population is actively replenished by immigration, with approximately 450,000 migrants entering the country annually. The constant influx of people from different countries creates a variety of tastes and preferences, which is an important factor for any exporter. The Ukrainian diaspora, with its current population of around 1.3 million, is a key conduit for the export of Ukrainian goods and services to the Canadian market.

“We see great opportunities for Ukrainian companies in the Canadian market, especially given the current changes in the global trade trends. Canada is actively seeking new partners and diversifying its supply chains. This opens great prospects for Ukrainian producers to fill the niches in this market. In addition, Canada is not only an important market, but also a strategic partner for attracting investment. Ukrainian start-ups that have already attracted investment in Canada are a vivid example of how the right strategic partners can help develop business and attract funding,” — noted Yuriy Kryvosheya, Vice President of the Canada-Ukraine Chamber of Commerce and Managing Partner of the Toronto-Kyiv Complex.

Trade and economic relations with Ukraine

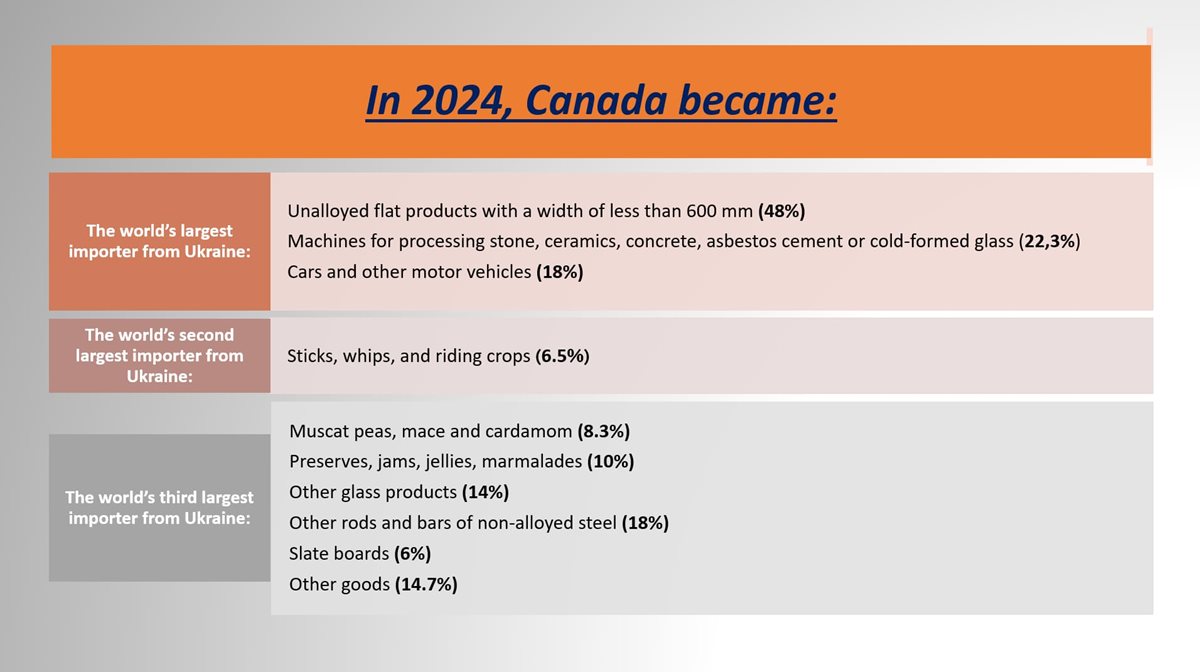

In 2024, the trade turnover between Ukraine and Canada reached $369.4 million. In 2024, Ukraine significantly increased its exports to Canada, namely by 55% ($152.1 million), marking an all-time high. The primary products of Ukraine’s exports to Canada in 2024 were inorganic chemicals (51.5% of the total), fats and oils (13.5%), processed vegetables (10.2%), base metals (4.9%), equipment (2%), meat and edible offal (2%), and furniture (1.9%).In 2024, Canada became the world’s largest importer of unalloyed flat products from Ukraine, with a width of less than 600 mm and machines for processing stone, ceramics, concrete, asbestos cement or cold-formed glass.

Despite a 33% decrease in Canadian imports to Ukraine last year ($217.3 million), the overall balance remains negative for Ukraine. The primary imported goods are machinery (17.9%), followed by land transport vehicles (15.8%) and fish and crustaceans (11.1%). Other significant import categories include mineral fuels and oil (10.3%), pharmaceuticals (7.2%) and base metals (3.1%).

Logistics solutions for exporting goods to Canada require careful planning. Major international airports such as Toronto and Vancouver are the main hubs for air freight, while the seaports of Montreal and Halifax are the main hubs for containerised shipments. The choice of port affects the cost and time of delivery, so it is advisable to choose the best route depending on the type of goods and the specifics of the shipment.

“The updated Canada-Ukraine Free Trade Agreement (CUFTA), which entered into force on July 1, 2024, opens up new opportunities for Ukrainian exporters, — noted Vasyl Bodnar, Counselor of economic issues at the Embassy of Ukraine in Canada. In particular, it provides for the abolition of import duties on most Ukrainian goods, greatly facilitating access to the Canadian market. However, it should be noted that certain exemptions apply to agricultural products, including poultry, dairy, raw eggs and egg products, which are subject to Canada’s global tariff quotas. Additionally, the agreement promotes the participation of Ukrainian producers in global supply chains by allowing the use of components from other countries, such as the EU, the UK and Israel, for goods exported to Canada duty-free. The agreement also simplifies conditions for temporary entry and labour mobility for businesspeople, as well as facilitating digital trade. This marks a significant milestone in fostering trade relations and deepening economic cooperation between the two nations.”

Another key development is the introduction of “Ukrainian shelves” in Canadian supermarkets. For instance, in January 2025, Ukrainian products are available on the shelves of Loblaws, Canada’s largest retail chain, in Etobicoke, Toronto. The initiative aims to promote Ukrainian goods and facilitate their access to Canadian consumers, particularly in light of the ongoing war and economic challenges faced by Ukraine. A key element of this initiative is the focus on food products, with a particular emphasis on traditional Ukrainian goods such as cheeses, sausages, honey, and savoury snacks, along with food items that align with Canadian market standards. There are plans to expand this project to other product categories.

How to find partners in Canada?

Finding partners in the Canadian market for Ukrainian exporters requires the use of several effective strategies and resources. First of all, the Canadian Importers Database where you can find Canadian importers, and the Directories of Canadian Companies to verify the reliability of potential partners are useful. In addition, Vasyl Bodnar recommends utilising LinkedIn to establish direct communication with company executives, as this platform is popular among Canadian businessmen.Canada has a large number of industry associations that can be useful in finding partners. For example, the National Industry Organisations contains a database of Canadian industry associations that can help you identify potential partners in various business sectors. Membership of these associations often provides an opportunity to network with key players in the market and obtain additional information on market specifics.

However, face-to-face communication is one of the best ways to make contacts. Attending trade shows in Canada allows companies to showcase their products and make direct contact with potential partners. Trade shows such as SIAL Canada (food products), Canada Farm Show (agriculture) and Global Energy Show (energy), are presentation and networking platforms where companies can make direct contact with potential partners.

Other important tools include trade data analysis platforms, such as Trade Data Online, and the use of the international platform NAZOVNI, created by the Ministry of Foreign Affairs of Ukraine to facilitate communication between Ukrainian entrepreneurs and embassies. A proactive approach and the use of all available resources will help you find partners and develop your business in the Canadian market.

“Canada is a great market for Ukrainian companies today, and this is the moment when it is important to have a clear plan for successful implementation in this market. Now is a very good opportunity to start cooperating with Canada, and we are ready to assist Ukrainian entrepreneurs establish contacts with Canadian partners. Particularly, with certification and meeting the requirements of Canadian retailers, which are key steps for successful market entry,” — said Emma Turos, the Executive Director of the Canada-Ukraine Chamber of Commerce in Ukraine.

Main requirements for doing business in Canada

Ukrainian companies do not need to register a legal entity in Canada to begin importing goods into Canada. Non-residents can be importers, but they must obtain a Business Number (BN) from the Canada Revenue Agency (CRA). The registration process is simple and free of charge. The importation of goods can be done independently or through a licensed customs broker. Important news is the transition to the new CARM (CBSA Assessment and Revenue Management) reporting system, which is now the primary tool for managing duties and taxes on commercial imports into Canada.“It is very important that all the terms that are important to you are clearly stated in the contract. This may seem obvious, but Ukrainian businesses often run into problems due to lack of specificity in agreements, resulting in costly litigation. Therefore, I strongly recommend that you pay attention to the choice of law and jurisdiction for dispute resolution, as this will have a significant impact on the cost and complexity of the process,” — commented Nataliia Wu, Associate Lawyer at Pallett Valo.

Nataliia also noted that it is common in Canada to pay after the goods or services have been received, so she recommends considering prepayment or credit insurance, or using escrow accounts for protection against payment delays.

For Ukrainian companies, there are two main organisational and legal options for doing business in Canada: a branch and a corporation. A branch is an extension of a Ukrainian company in Canada and is not a separate legal entity, while a corporation is an independent legal entity that limits the risks of investing in a Canadian company.

“Incorporating a company is a better option as it offers liability protection and simpler taxation,” — noted Nataliia.

The process of registering a corporation is quick and usually takes 48 hours after the company name is approved, and the cost of registration is approximately $2,000. When registering a federal corporation, at least 25% of the board members must be Canadian residents, or at least one director if the board consists of less than four people. However, in the province of Ontario, the residency requirements for directors are less strict, allowing you to have a board of directors consisting only of non-residents. In addition, there are no minimum capital requirements and you can invest even $1.

Franchising is a popular business model for Ukrainian companies in Canada. In Ontario, there are even specific protections for franchisees, which are regulated by the Arthur Wishart Act (Franchise Disclosure). Registration of a legal entity in Canada is mandatory for franchisors, and specific requirements governing this model must be followed.

Investments by foreigners in Canada are regulated by the Investment Canada Act. All foreigners who acquire control of a Canadian business or establish a new business must comply with the requirements of this law, including filing information on the sources of investment and undergoing reporting procedures before starting investment activities in Canada.

Government’s role in supporting Ukrainian exporters

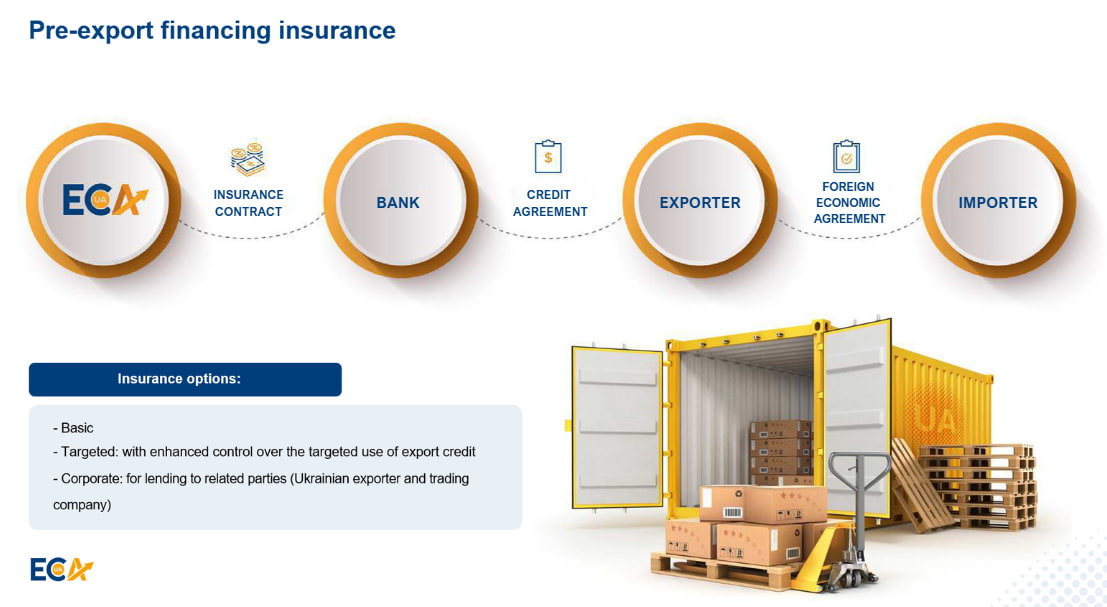

When it comes to export risks, it is important to consider both possible financial losses and strategic solutions to ensure the reliability of transactions. In this context, the Ukrainian Export Credit Agency (ECA) plays an important role by providing support to businesses dealing with the risks of non-payment in international markets. This is especially important for companies that enter new markets and cannot be fully confident in the financial discipline of their partners. In addition, the agency not only insures contracts but also analyses them thoroughly, helping to identify potential risks at the signing stage. “It is worth noting that the Export Credit Agency supports only those businesses that produce value-added products. We have certain restrictions on the UKTZED code regarding raw materials, but if you process something, you can be sure that with a 99% probability, the ECA will support the product,” — explained Denys Garasiuta, Board Member, Head of Retail and SME Department at the ECA.

He also added that a special plugin has been implemented on the agency's website to check whether products meet ECA requirements, which allows determining whether they are eligible for insurance support.

Apart from risk insurance, the ECA provides Ukrainian exporters with an opportunity to obtain financing for contract fulfilment. This is due to the mechanism of risk insurance for banks that issue loans to businesses under export agreements. In such cases, the agency assumes the risk of loan non-repayment, thereby making it easier for businesses to access financial resources.

Another important tool is bank guarantee insurance. Large international companies often require guarantees for the fulfilment of contracts, and thanks to insurance from the ECA, Ukrainian companies can obtain such guarantees without the need to withdraw significant funds from circulation.

The agency has also recently introduced a new line of business: investment insurance against military and political risks. This is of particular relevance to Ukrainian companies that keep operating and expanding production even in times of war. This is not property insurance. It is an investment that is insured — a financial transaction made by an investor when he or she invested money in a company. If the company loses its ability to operate as a result of hostilities, the ECA covers these losses. This tool helps protect business investments and stimulate further economic development even in difficult conditions.

Today, the ECA is actively engaged in simplifying the interaction of businesses with the agency and financial institutions. In particular, in the near future, the agency will integrate its services into the Diia.Business platform, which will allow businesses to receive the necessary advice and apply for transaction insurance faster.

Although exports to Canada from Ukraine have increased, Denys Garasiuta noted that this area is still not sufficiently covered by the ECA. According to him, Canada ranks 38th among the countries in which ECAs have supported exports, with an amount of only UAH 8 million. In comparison, Poland, which is our closest neighbour, has supported exports in the amount of UAH 6 billion. This means that Ukrainian companies planning to enter the Canadian market have a huge potential to expand their presence, and the ECA is ready to provide them with the necessary support to minimize risks and attract financing.

Compliance with Ukrainian currency and tax regulations for operations in international markets

One of the main challenges for Ukrainian companies exporting to Canada is compliance with currency control regulations. It is crucial to note that even if export proceeds are credited to an account opened by a Ukrainian company in Canada, they are still subject to Ukrainian currency regulations.“Our 180-day rule for the return of foreign currency earnings also applies to accounts opened abroad, including in Canada. In the event that the funds are not returned to Ukraine within the specified timeframe, the company may be subject to a penalty of 0.3% of the amount not returned,” — noted Vyacheslav Petrashenko, Senior Lawyer at BDO in Ukraine.

It is also important to note that Canada has a widespread post-payment practice, where payment for goods is received 30-120 days after delivery. Ukrainian companies should be well-aware of the timings, as Ukrainian legislation stipulates clear requirements for the timing of export revenue.

Registering a legal entity in Canada can facilitate business operations. However, due to the war in Ukraine, there are restrictions on transferring funds abroad to invest in foreign companies. Prior to the war, the National Bank permitted up to €2 million per annum to be invested in the charter capital of foreign companies, but this is no longer possible. There are, however, alternative mechanisms that can be properly structured. One such option is to contribute funds to the charter capital through an individual who opens an account with a Canadian bank. Experts also recommend registering companies with a minimum authorised capital to avoid difficulties with investing significant amounts.

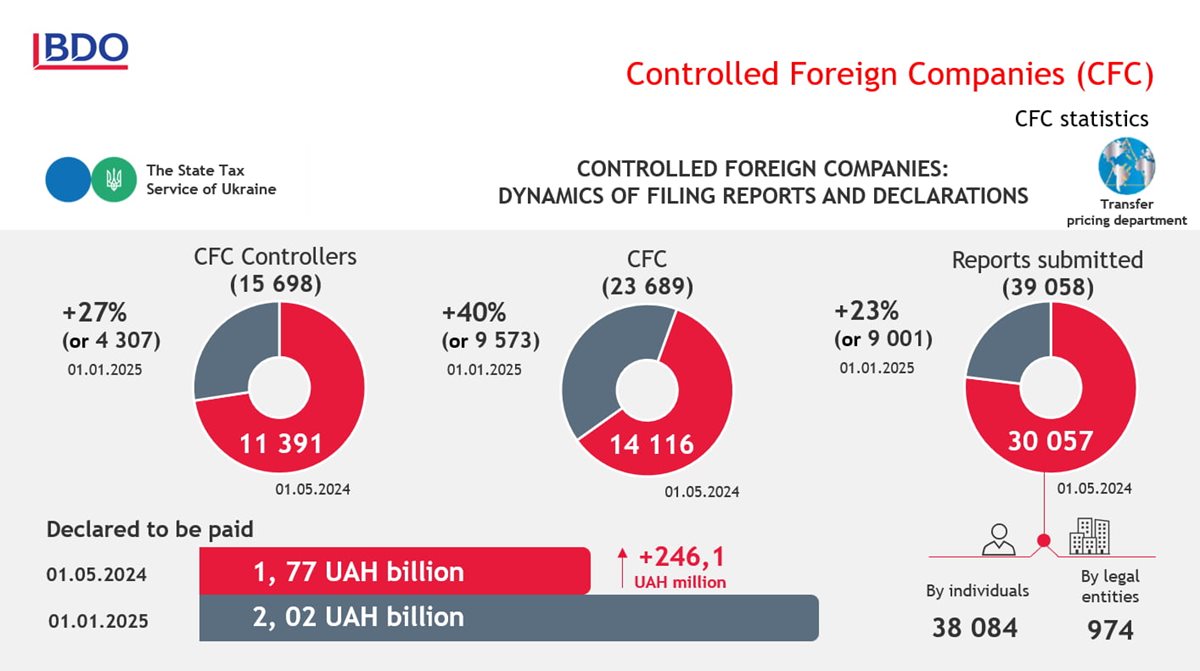

Ukrainian companies or individuals owning businesses abroad are required to file reports on Controlled Foreign Companies (CFC). According to the State Tax Service of Ukraine, more than 39,000 such reports have already been filed as of 2025, and the amount of taxes accrued based on their results has exceeded UAH 2 billion. It is also mandatory for Ukrainian companies or individuals establishing a business in Canada to file reports. Failure to file such reports can result in penalties of up to $20,000. Currently, due to the martial law, the imposition of fines for CFC reporting violations has been temporarily suspended; however, this will resume once martial law has been lifted.

Another issue was the registration of trademarks. A Ukrainian trademark is only protected in Ukraine. Therefore, if it coincides with the name of a Canadian store chain, the company may face legal problems. There are two options available to address this issue: either to register the trademark directly in Canada or to use the international registration procedure under the Madrid System, as it allows for legal protection in several countries at once.

Canada is a large but complex market. This means that Ukrainian exporters must be flexible and ready for constant change. It is crucial to be proactive and not delay contacting specialists who can help expedite entry into a new market with a minimal risk to your business. We are committed to supporting our exporters and invite you to contact BDO in Ukraine or the Canada-Ukraine Chamber of Commerce. By working together, we can develop the best solution for you..

The webinar recording is available below.