Political and war risks mitigation possibilities

Political risks are associated with government actions which deny or restrict the right of an investor/owner i) to use or benefit from his/her assets; or ii) which reduce the value of the firm. Political risks include war, revolutions, government seizure of property and actions to restrict the movement of profits or other revenues from within a country.

By purchasing political risk insurance (PRI), investors can successfully strengthen their position in the host state, allocating the burden of political risk to third parties (insurance agencies). PRI is provided by international organizations, such as the Multilateral Investment Guarantee Agency (MIGA) and state-sponsored insurance agencies, known as export credit agencies (ECAs) or public insurance agencies.

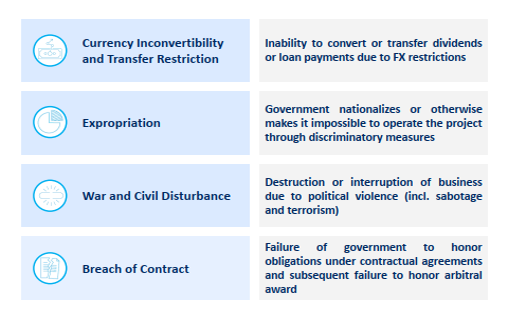

Political risks covered PRI providers cover very similar sets of political risks:

- Currency inconvertibility and transfer restrictions.

- Confiscation, expropriation, nationalization.

- Political violence/war.

- Default on obligations such as loans, arbitral claims, and contracts.

Most credit agencies have frozen their limits for Ukraine because of the lack of instruments in place.

War risk - risks associated with war, such as physical damage to goods and assets, hostile occupation, and contract obligation breaches for war-related reasons, including bank loans, goods, or services supply. It should cover not only total losses of property but also damages of a moderate scale.

1. MIGA - Multilateral Investment Guarantee Agency

MIGA is a member of the World Bank Group. MIGA’s mandate is to promote cross-border investment in developing countries by providing guarantees (political risk insurance and credit enhancement) to investors and lenders.

MIGA provides political risk insurance guarantees and credit enhancement to private sector investors and lenders. MIGA’s guarantees protect investments against non-commercial risks and can help investors obtain access financing on improved terms and conditions.

MIGA’s War and Civil Disturbance coverage provides protection against loss from, damage to, or the destruction or disappearance of, tangible assets or total business interruption (the total inability to conduct operations essential to a project’s overall financial viability) caused by politically motivated acts of war or civil disturbance in the country, including revolution, insurrection, coups d’état, sabotage, and terrorism.

For tangible asset losses, MIGA pays the investor’s share of the lesser of the replacement cost and the cost of repair of the damaged or lost assets, or the book value of such assets if they are neither

being replaced nor repaired. For total business interruption that results from a covered war and

civil disturbance event, compensation is based, in the case of equity investments, on the net book value of the insured investment or, in the case of loans, the insured portion of the principal and interest payment in default. This coverage encompasses not only violence in the host country directed against a host country government, but also against foreign governments or foreign investments, including the investor’s government or nationality.

Temporary business interruption may also be included upon a request from the investor and would cover a temporary but complete cessation of operations due to loss of assets or unreasonably hazardous conditions in the host country, which result in a temporary abandonment or denial of use. For short-term business interruption, MIGA pays unavoidable continuing expenses and extraordinary expenses associated with the restart of operations and lost business income or, in the case of loans, missed payments.

MIGA covers capital and debt insurance up to 90%.

Cost of insurance for Ukraine is belived to be up to 1%

MIGA’s Product Lines available in Ukraine

Political Risk Insurance (PRI) solutions for Investors and Lenders

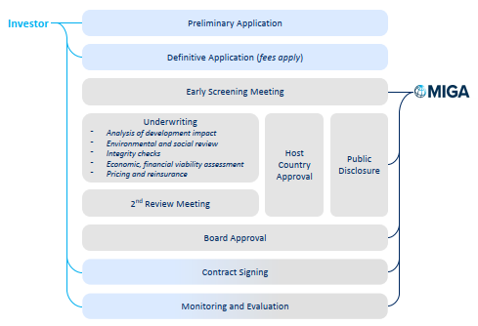

Registration and Underwriting Process

2. List of International Export Credit Agencies and other organisations that announced support to Ukraine

| No | Country | Agencies | Web | Conditions | |

| 1 | Austria | OeKB | https://www.oekb.at/en/oekb-group/news-und-wissen/news/2023/ukraine -weitere-oeffnung-deckung.html | Covering and financing exports: Supplier credit Sale of receivables Buyer credit Cover of letter of credit confirmations Leasing Concessional financing (soft loan) Production financing Down-payment financing Assumption of risk for bank guarantees Guarantee for use of machinery Stock in commission Private credit insurance With OeKB, you are guaranteed to get the right solution when covering the risk of your exports, whether they are goods or services. Even high-level commercial and political risks that the private credit insurance market doesn’t cover can be covered. With your bank as a partner, we can also finance covered transactions at particularly attractive rates. This means you get your money quickly as an exporter, and your customer can pay for the investment over a longer period. | |

| 2 | Belgium | CREDENDO | https://credendo.com/en/knowledge-hub/credendo-announces-it-will-resume-cover-ukraine | Buyer Credit InsuranceThe Belgian government asked Credendo to resume coverage of export transactions on Ukraine, acting for the account of the Belgian State. An amount of EUR 100 million will be made available for this purpose, of which EUR 75 million for short-term transactions (risk duration of maximum one year) and EUR 25 million for medium- to long-term transactions (risk duration above one year). That ceiling could later be raised based on positive experience. Insurance will be made available for transactions with sufficient Belgian interest and for a maximum of EUR 15 million per transaction. Moreover, where necessary, guarantees from Ukrainian banks or authorities will be required. | |

| 3 | Canada | Export Development Corporation | https://www.edc.ca/en/article/faqs-russia-ukraine-conflict.html | As international risk experts, EDC helps Canadian companies to navigate, manage and take on risk to support their growth beyond Canada’s borders. EDC`s solutions include: • Capital – access to working capital and financing • Risk mitigation – insurance that lowers the risk of doing business abroad • Trade knowledge – expertise to help companies make informed decisions • Global connections – relationships that connect Canadian and international companies and help both parties grow | |

| 4 | Czech Republic | Export Guarantee and Insurance Corporation | | EGAP.cz | On April 17th 2024, the Czech government approved a new policy by the Ukraine EGAP Fund, allowing for the insurance of Czech companies' exports to Ukraine up to EUR 5 million without the need to confirm previous relationships between the parties. At a meeting on April 19th with EGAP's management, the possibility of further simplification of conditions was discussed, as Ukraine has so far fulfilled all obligations and no insurance payouts have been necessary. Additionally, the National Development Bank of the Czech Republic will administer part of the EU funds for Ukraine, potentially providing guarantees for international orders. | |

| 5 | Denmark | Export and Investment Fund of Denmark | https://www.eifo.dk/en/knowledge/ news/new-reinsurance-scheme- reduces-the-risk-of-trading-with-ukraine/ | An insurance solution from EIFO makes sure that 1)you will be compensated for your loss in case your customer suddenly goes bankrupt or cancels the order 2)you can accept new orders in spite of risk of war and political unrest in a country 3)you can focus on new business transactions rather than worrying about the risks related to previous transactions | |

| 6 | Finland | Finnvera Oyj, Finnish Export Credit Ltd (FEC) | https://www.finnvera.fi/eng/f innvera/newsroom/news/finnveras-export-credit-guarantees-help-promote-ukraines-reconstruction-efforts | Finnvera with up to EUR 50 million in compensation for credit losses sustained in connection with export credit guarantees granted for the promotion of exports and investments to Ukraine. Finnvera will resume granting export credit guarantees from 1 January 2024. This arrangement applies particularly to financing options for short-term trade (such as documentary credit guarantees and credit insurance), which are particularly important for securing SME exports. The provision of export credit guarantees for medium and long-term trade can also be gradually increased. | |

| 7 | France | Bpifrance | https://www.bpifrance.fr/ | The French state-owned insurance company Bpifrance Assurance Export will insure French companies that are ready to invest in Ukraine and take an active part in the country’s reconstruction without waiting for the war to end. Any company operating under French law and making a long-term investment abroad in a new or existing company, or any credit institution providing a bank loan to a foreign subsidiary, is eligible for this investment insurance. It protects investors or lending institutions against the risks of property damage or non-payment, non-transfer, expropriation or political violence. The insurance covers up to 95% of the loss of the investor’s assets or receivables. | |

| 8 | Germany | Investment Guarantees (agent PWC) | https://www.investitionsgarantien.de /news/ukraine-krieg/bundesregierung-verbessert-die-garantiekonditionen | A Supplier Credit Guarantee offers protection against payment default, in particular if: 1)a foreign buyer becomes insolvent 2)the foreign buyer fails to make payment within 6 months (protracted default) 3)adverse measures are taken by foreign governments or warlike events arise 4)local currency amounts are not converted or transferred 5)contract performance becomes impossible due to political circumstances | |

| 9 | Italy | SACE | https://www.sace.it/media/comunicati-e-news/dettaglio-comunicato/simest-(gruppo-cdp)-al-via-le-misure-per-pmi-e-midcap-colpite-dalla-crisi-ucraina | INVESTMENT PROTECTION. With SACE investors can safely invest abroad, getting insurance against the risk of loss of invested capital, interests and profits due to political events. SACE covers business from expropriation, nationalization, war and civil unrest, currency restrictions and breach of contract. In addition, if investors are unable to continue operations abroad due to war or civil unrest, with SACE they can recover loss of profit. Italian companies and their subsidiaries abroad planning to make foreign direct investments can get benefits: Safely invest abroad. Insurance of sums due to investors by way of future dividends, revenues from the sale of the investment and interests on shareholder’s loans. Possibility of transferring policy rights to a bank to obtain better terms of financing for then foreign subsidiary. Equity investment supported by SIMEST can be insured against political risks. SACE takes equity participation in foreign direct investments, providing additional financial resources to safely grow and expand into foreign markets. SIMEST takes direct participation in up to 49% of the equity of foreign Italian subsidiary for a maximum duration of 8 years. If the company is established in a non-EU country, SACE can also offer interest rate subsidy. SIMEST’s participation can be considered for establishing the company, for capital injection and/or M&A transactionss. April 26, 2023, the Italian Export Credit Agency SACE is ready to resume work with Ukraine, which is a very important signal for Italian business, and, in addition to the previously announced €500 million, will allocate an additional €1 billion to support trade and financial operations. | |

| 10 | Japan | NEXI (Nippon Export and Investment Insurance) | https://www.nexi.go.jp/en/topics/ newsrelease/202402150245.html | NEXI covers losses incurred from i) the Commercial Risks in which the counterparty of overseas transactions such as trade is responsible, and ii) the Political Risks that arise from overseas transactions such as trade for which the party concerned are not responsible. | |

| 11 | Latvia | ALTUM | https://www.altum.lv/en/services/ enterprises/kara-seku-atbalsts/ https://www.altum.lv/en/services/ enterprises/support-of-the-consequences- | Use State support for exporters – export credit guarantee: Use State support for exporters – export credit guarantee: 1)The guarantee covers buyer’s and political risks 2)Covers the risk of the guarantor of the buyer’s obligations – bank or buyer’s associated company 3)Serves as additional security for guarantees or a letter of credit issued by the buyer’s bank if there are doubts about the bank’s liquidity 4)Serves as a collateral in factoring or for obligations to a bank to secure financing for other current assets | |

| 12 | Netherlands | Atradius | https://atradiusdutchstatebusiness.nl/en/ news/eca-support-package-for-ukraine..html | You may take out cover solely for post-delivery or post-completion payment risk (credit risk) or in combination with cover for the costs you will incur prior to the delivery of your goods or completion of your work on the project (pre-delivery risk). Non-payment may be due to circumstances in your client’s country such as war, natural disasters or a government’s financial difficulties (political risks). It may otherwise be due to financial difficulties experienced by your client (commercial risk). Depending on the situation, you may choose to insure only political or only commercial risks. Deductible/Insured’s Own Risk: The percentage of cover we can offer under an insurance policy for contractors is flexible. It will be fixed at a percentage which is usually between 90% and 98% of the contract value. You will therefore bear the risk for the remainder, i.e. at minimum 2% and at maximum 10% of the contract value. This is known as your deductible or own risk. You may transfer this risk to other parties to the transaction, such as your bank or suppliers. You must however apply for and obtain written approval from Atradius for this before your contract enters into force. | |

| 13 | Poland | KUKE | https://kuke.com.pl/en/news-and- insights/eur-53-6-million-to-support-polish-exports-in-ukraine | KUKE is the official Polish export credit agency that provides solutions in the form of credit insurance, guarantees, factoring, and investment insurance. Solutions for banks, small and large companies. KUKE is the official Polish export credit agency that provides solutions in the form of credit insurance, guarantees, factoring, and investment insurance. Solutions for banks, small and large companies. KUKE can protect the outlays borne by Polish investors against losses caused by risky political events in investment countries. The insurance covers documented pecuniary and tangible expenditures as well as intangible and legal assets (net) invested in a foreign business, which give the right to participate in profits, in the estate in bankruptcy, guarantee the right to vote and to supervise and co-manage. The insurance covers losses incurred in connection with the execution of a direct investment abroad as a result of events referred to as political risk and force majeure. Decisions in the form of government interventions preventing an investment from going ahead. The announcement of a universal payment moratorium. Decisions concerning trade restrictions consisting of prohibitions on exports. The transfer of receivables being rendered impossible (e.g. dividends). The exercise of rights related to an investment being rendered completely impossible. War, revolution, riots, protracted mass strikes, earthquakes, volcano eruptions, typhoons, flood, and fires of catastrophic dimensions. | |

| 14 | Slovakia | Eximbanka SR | https://eximbanka.sk/en/other-forms-of-export-support/ukraine-export-investment-and-economic-recovery/ | Coverage of short-term receivables EXIMBANKA SR started covering short-term receivables (up to 90 days and up to a total limit of 10 million euros). This limit is actively used by Slovak exporters and is mainly used to cover both commercial and political risks (under enhanced conditions). This is mainly the export of products of the agricultural and food sectors, steel products, pharmaceutical products, products of the chemical industry. | |

| 15 | Sweden | EKN, Exportkreditnämnden | https://www.ekn.se/garantier/mer-om-garantier/fragor-och-svar-om-garantier-till-ukraina/ | The Ukraine Regulation only applies to guarantees to cover losses in connection with export transactions with goods to Ukraine. The warranty covers the risk of non-payment on the part of the buyer. EKN's ordinary terms and conditions for products are applied, with the necessary adaptations to the special regulation. EKN must settle any claims for non-payment before the end of 2026. As a result, EKN will not be able to guarantee receivables that fall due later than can be dealt with in the claims adjustment process, preliminarily August 2026. If the repayment period with the Ukrainian buyer is longer, EKN does not bear that risk. EKN can cover a maximum of 80 per cent of the guaranteed commitments. The terms and conditions for an export credit guarantee under the special Ukraine Regulation must be designed so that the guarantee holder and EKN bear losses proportionately and in the same way. EKN can cover a maximum of 80 per cent of the guaranteed commitments. The terms and conditions for an export credit guarantee under the special Ukraine Regulation must be designed so that the guarantee holder and EKN bear losses proportionately and in the same way. The total guarantee framework for which EKN can issue a guarantee to Ukraine is SEK 333 million. A guarantee can be applied for a maximum of SEK 100 million per applicant in the same group of companies.However, this limitation does not apply if there is room in the guarantee framework when there are six months left of the period during which EKN can issue guarantees, i.e. as of 30 June 2024. | |

| 16 | UK | UK Export Finance | https://www.gov.uk/government/news/new-insurance-scheme-to-facilitate-uk-business-supporting-ukraine?ref=ukrainerebuildnews.com | UK government helping plan war-risk insurance scheme which will lead UK companies to do business in Ukraine Lack of available insurance currently a major barrier preventing UK companies trading with and investing in Ukraine to help it rebuild Business and Trade Minister The Earl of Minto inks agreement today at the European Bank for Reconstruction and Development The UK will today sign a Statement of Intent on a European Bank for Reconstruction and Development (EBRD) war-risk insurance scheme for Ukraine. The EBRD’s effort, along with complementary backing by other international financial institutions, over time will help UK companies to do business in Ukraine and support its reconstruction. | |

| 17 | USA | DFC - U.S. International Development Finance Corporation | https://www.dfc.gov/media/press-releases/joint-declaration-support-trade-finance-ukraine | Types of Coverage:

|

The information contained in this document is gathered from open sources, and not guaranteed as being accurate and does not purport to be a complete statement or summary of the available data. BDO assumes no responsibility or liability of any kind, as to the accuracy or completeness of any information and opinions contained in the document.

Agencies that not cover yet war risks, but provide support for local producers while

| No | Country | Agencies | Web | Conditions | |

| 18 | Ireland | Ireland I Credento | https://www.gov.ie/en/press-release/fd9e9-ministers-coveney-mcgrath-and-mcconalogue-announce-first-lender-to-the-market-for-12-billion-ukraine-credit-guarantee-scheme/ | This scheme has a lending ceiling of €1.2 billion and will facilitate loans for working capital and medium-term investment. The important features are: 1) no personal guarantee or collateral required for loans up to €250,000 2)loans of up to 6 years and €1 million 3)reduced interest rates (vs standard market rates) available until 31 December 2024 and includes farmers, fishers and small mid-caps 4)open call has encouraged variety of lenders to participate, including non-banks and credit unions 5)pre-eligibility available on SBCI Hub which speeds up the process. Businesses will have certainty that their liquidity funding needs can be met through low-cost loans supported by the government. This is a central pillar of the government’s response to aid businesses impacted by rapidly rising costs as a result of the invasion of Ukraine. | |

| 19 | Romania | Exim Banca Romaneasca | https://www.eximbank.ro/en/2022/12/08/schema-de-ajutor-de-stat-ucraina/ | Covered risks 1)Commercial risks – Risk of unjustified execution of export guarantees by the commercial partner, while the insured party met its obligations within the auction and/or the contractual obligations; 2)Political risks: -Risk of executing export guarantees due to the exporter’s incapacity to meet its contractual obligations due to the occurrence of political risks in the Debtor’s country or in a third country, such as: the risk that a public debtor or a country to prevent the achievement of an export transaction; risks exceeding the will of individual buyers, or which are not the responsibility of individual buyers; -Risk of executing export guarantees by the Debtor, in the conditions when the contract continuation makes no longer an economic sense due to the instating of sanctions or payment moratoria which prevent the Debtor to pay on maturity. |