Andrii Borenkov, CFA

In today’s business environment, effective financial management and investment project evaluation are essential for a company’s stable development.

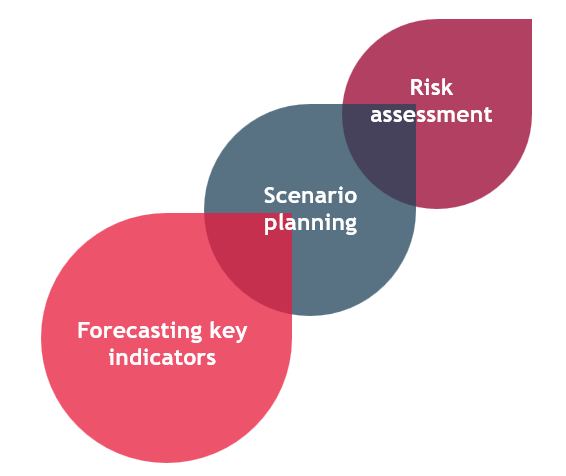

We offer comprehensive financial modeling services for businesses, including forecasting key indicators, scenario planning and risk assessment.

These financial models allow us to accurately determine funding needs, estimate profitability and forecast cash flows, providing transparency for investors, creditors and management alike. Additionally, we can customize the client’s existing financial models to improve the quality of forecasting and display of business processes, considering the best international practices of financial management.

At BDO in Ukraine, we integrate proven methodologies with a flexible approach to the specifics of the industry and the characteristics of each business:

We create a structure for the company’s financial and investment activities that considers internal and external factors, key performance indicators, industry trends, current projects and prospective investments. If the existing model is modified, the client can receive a significantly improved forecasting tool in a familiar format.

We assess how macroeconomic shifts or internal factors impact the financial stability, profitability, and cash flows of an enterprise.

We assist in determining the market value of an enterprise, conducting comparative analyses and formulating clear arguments for negotiations with potential investors or partners. We utilize proven investment project valuation methods and financial planning techniques.

We offer professional guidance on financial planning for businesses and develop reporting materials in a convenient format to facilitate prompt decision-making.

Results and advantages

Thorough financial modeling allows companies to plan their development, optimize their capital structure, and manage risks to increase the profitability of their projects. With our help, you will get

Therefore, financial modeling is a reliable tool that enables informed, forward-thinking decision-making, thereby contributing to the stable growth and competitiveness of your business.

Please, contact BDO in Ukraine!

Our experts will help you create an effective financial model for your company that will ensure financial stability, optimize cash flows and increase business profitability. We will provide solutions for effective financial management, investment evaluation and risk minimization.

Our best measure is your success!

Andrii Borenkov, CFA