BDO in Ukraine has prepared a comprehensive report on the current state, historical indicators and prospects for the development of the oil and oilseeds market.

The document provides a comprehensive analysis of industry trends, export potential, changes in logistics and infrastructure, and key forecasts for the Ukrainian market.

The objective of this review is to provide businesses, investors and all stakeholders with a comprehensive understanding of the market, enabling them to assess its opportunities and challenges and make strategic decisions based on up-to-date data.

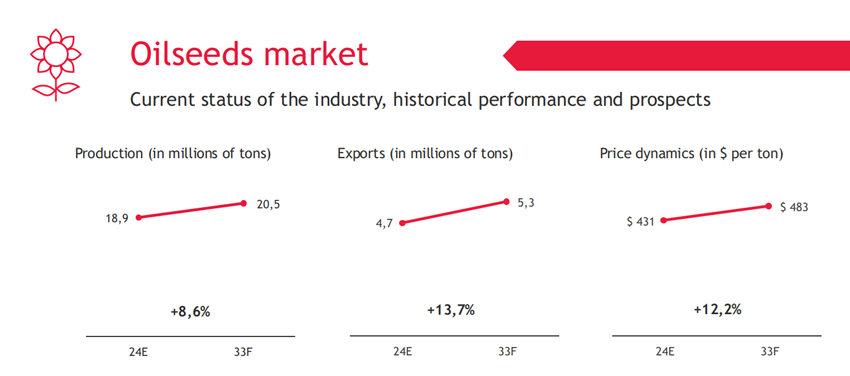

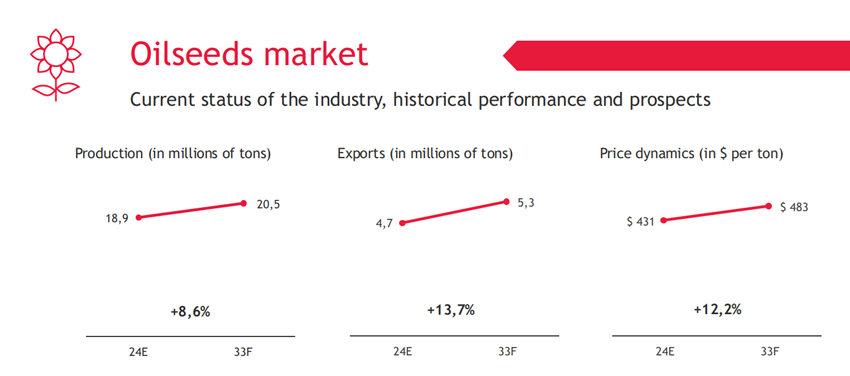

In 2023-2024, Ukraine’s oilseed production is expected to remain stable, enabling the country to meet domestic demand and increase exports. Sunflower remains the leading crop, accounting for 80% of the total production structure. Farmers are actively diversifying their sown areas, increasing the share of rapeseed and soybeans.

The industry remains profitable for agricultural producers due to high prices. Additionally, processing facilities are being developed, contributing to the growth of exports of high-value-added products.

The export of oilseeds and their processed products continues to grow, strengthening Ukraine’s position on the global market. Sunflower oil remains the main export product, accounting for over 60% of foreign exchange earnings. There is an increasing share of rapeseed and soybean oils, indicating the diversification of the product portfolio.

The primary purchasers of Ukrainian products are the EU, China, India, and other Asian markets. Investments in port infrastructure and logistics chains have optimized transportation and increased supply volumes.

The expansion and modernization of processing capacities have become crucial elements in the industry’s growth. The introduction of new elevators, grain storage facilities, and logistics hubs has enhanced storage and transportation efficiency. The implementation of cutting-edge IT solutions has streamlined trading and supply management processes.

In 2023-2024, the market saw a notable influx of capital from Ukrainian agricultural holdings and foreign companies. Investors are directing their attention towards the implementation of cutting-edge agricultural technologies, the establishment of processing facilities, and the expansion of export infrastructure.

The Ukrainian oilseeds market is demonstrating resilience and growth potential, meeting both domestic demand and global market competitiveness.

Experts of BDO in Ukraine are always ready to provide professional support and effective solutions for the development of agribusiness. Our Agribusiness group closely monitors market trends and offers up-to-date information to respond to changes in a timely manner. Subscribe to our updates and seek professional advice using the contacts provided.

*The information provided in this publication is for general guidance only and does not constitute professional advice or service. Before making any decisions or taking any action that may affect your finances or business, we advise you to seek the advice of a qualified professional advisor.

The objective of this review is to provide businesses, investors and all stakeholders with a comprehensive understanding of the market, enabling them to assess its opportunities and challenges and make strategic decisions based on up-to-date data.

Current state and prospects of the oilseeds market in Ukraine

State of the industry

In 2023-2024, Ukraine’s oilseed production is expected to remain stable, enabling the country to meet domestic demand and increase exports. Sunflower remains the leading crop, accounting for 80% of the total production structure. Farmers are actively diversifying their sown areas, increasing the share of rapeseed and soybeans.The industry remains profitable for agricultural producers due to high prices. Additionally, processing facilities are being developed, contributing to the growth of exports of high-value-added products.

Export and logistics

The export of oilseeds and their processed products continues to grow, strengthening Ukraine’s position on the global market. Sunflower oil remains the main export product, accounting for over 60% of foreign exchange earnings. There is an increasing share of rapeseed and soybean oils, indicating the diversification of the product portfolio.The primary purchasers of Ukrainian products are the EU, China, India, and other Asian markets. Investments in port infrastructure and logistics chains have optimized transportation and increased supply volumes.

Infrastructure changes

The expansion and modernization of processing capacities have become crucial elements in the industry’s growth. The introduction of new elevators, grain storage facilities, and logistics hubs has enhanced storage and transportation efficiency. The implementation of cutting-edge IT solutions has streamlined trading and supply management processes.

Investment activity

In 2023-2024, the market saw a notable influx of capital from Ukrainian agricultural holdings and foreign companies. Investors are directing their attention towards the implementation of cutting-edge agricultural technologies, the establishment of processing facilities, and the expansion of export infrastructure.

Development forecasts

- Exports: Ukraine remains an important player in the global market, accounting for over 87% of total exports. The projected CAGR to 2033 is +0.7%.

- Production: Volumes remain competitive, although still not reaching the record levels of 2019.

- Domestic demand: Average annual oil consumption in Ukraine continues to grow, indicating stable demand and the potential for convergence with global levels.

- Prices: Ukrainian oil maintains a competitive advantage due to its lower price compared to global markets.

The Ukrainian oilseeds market is demonstrating resilience and growth potential, meeting both domestic demand and global market competitiveness.

Experts of BDO in Ukraine are always ready to provide professional support and effective solutions for the development of agribusiness. Our Agribusiness group closely monitors market trends and offers up-to-date information to respond to changes in a timely manner. Subscribe to our updates and seek professional advice using the contacts provided.

*The information provided in this publication is for general guidance only and does not constitute professional advice or service. Before making any decisions or taking any action that may affect your finances or business, we advise you to seek the advice of a qualified professional advisor.